karol632799159

About karol632799159

Understanding Straightforward Loans For Bad Credit: No Credit Check Options

In today’s financial landscape, many individuals find themselves in a difficult position in terms of acquiring loans attributable to bad credit or a lack of credit historical past. Here’s more on bestnocreditcheckloans.com take a look at our own page. Conventional lenders often rely heavily on credit scores to determine eligibility, leaving these with poor credit scores or no credit history feeling helpless. Nevertheless, there are options available for these in want of quick monetary assistance, significantly by means of straightforward loans that don’t require a credit score check. This report explores the forms of simple loans available for people with bad credit, the implications of no credit checks, and the potential risks and advantages associated with these lending choices.

Understanding Bad Credit and No Credit Check Loans

Bad credit sometimes refers to a credit score rating that falls beneath 580 on the FICO scale, which can be the result of late funds, defaults, or excessive credit utilization. On the other hand, individuals with no credit historical past may be young adults simply starting to build their credit or these who’ve prevented credit products altogether. Both teams might face difficulties when searching for conventional loans, as lenders typically view them as excessive-danger borrowers.

No credit check loans are monetary merchandise that enable borrowers to secure funds without the lender checking their credit score. These loans might be interesting for these with poor credit score or no credit historical past, as they supply a possible lifeline throughout emergencies or unexpected bills. Nonetheless, it is essential to grasp the assorted sorts of no credit check loans out there, as well as their terms and situations.

Forms of Simple Loans for Bad Credit

- Payday Loans:

Payday loans are short-time period, high-curiosity loans which can be usually due on the borrower’s subsequent payday. They are sometimes marketed as simple loans for bad credit since they do not require a credit score check. Nonetheless, these loans can carry exorbitant interest charges, generally exceeding 400% APR. Borrowers should be cautious, as failing to repay a payday loan can result in a cycle of debt.

- Title Loans:

Title loans enable borrowers to make use of their vehicle as collateral to secure a loan. Lenders usually don’t check credit score scores, making it accessible for these with bad credit. Nonetheless, if the borrower fails to repay the loan, they threat dropping their vehicle. Curiosity rates may also be high, and the loan quantity is often limited to a share of the car’s worth.

- Personal Installment Loans:

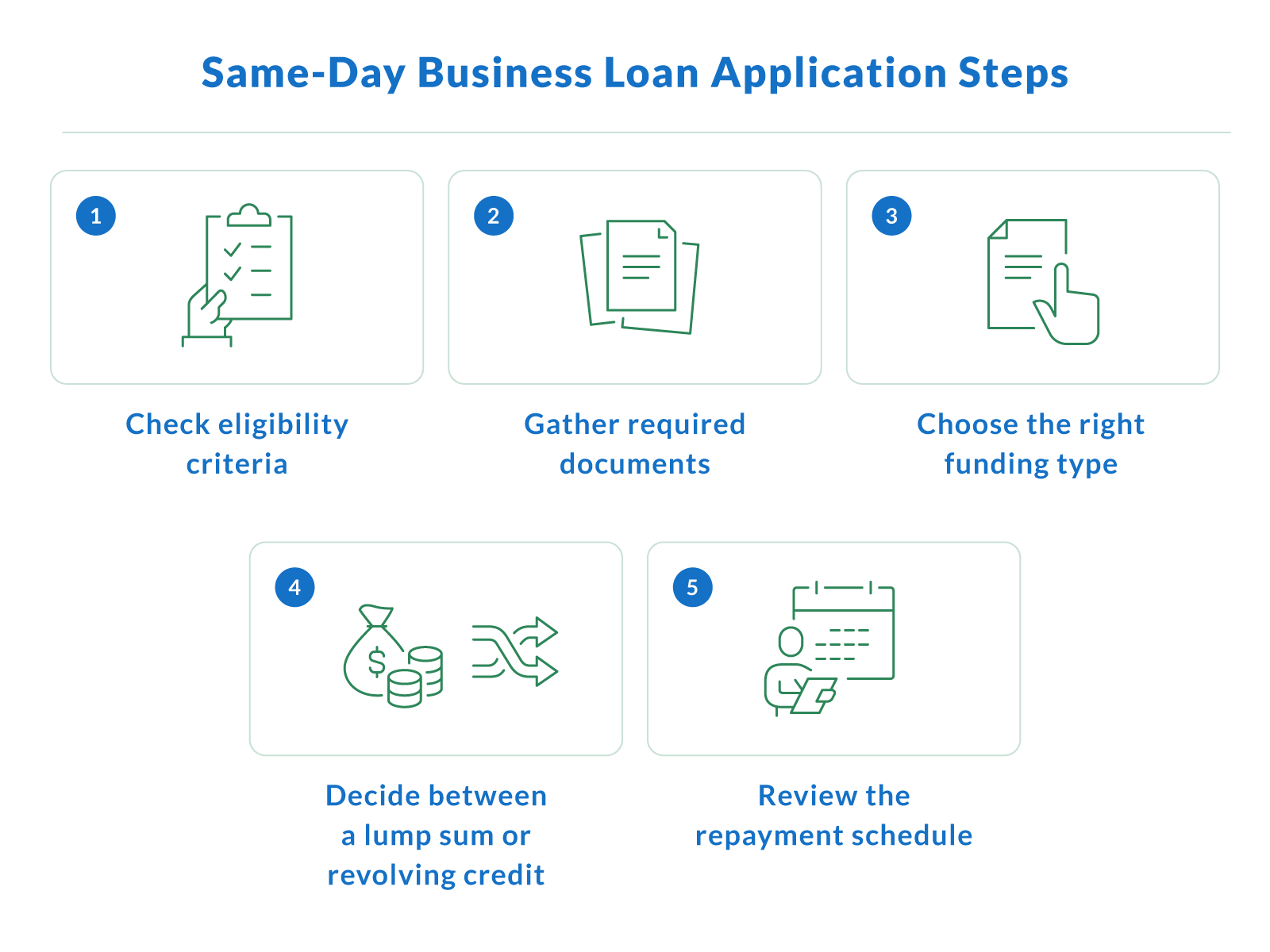

Some lenders provide personal installment loans that don’t require a credit score check. These loans allow borrowers to receive a lump sum and repay it in fastened month-to-month installments over a specified period. Whereas they might have lower interest rates than payday or title loans, borrowers ought to fastidiously overview the phrases and ensure they will meet the repayment schedule.

- Peer-to-Peer Lending:

Peer-to-peer (P2P) lending platforms join borrowers straight with individual investors prepared to fund loans. Whereas some P2P platforms could consider credit scores, others are extra lenient and should not conduct credit checks. Borrowers can profit from competitive curiosity rates, but they should be ready to provide different documentation to reveal their ability to repay the loan.

- Cash Advances:

Credit card cash advances allow cardholders to withdraw cash against their credit restrict. While this option does not require a credit check, it typically comes with high fees and curiosity charges. Additionally, cash advances can negatively influence the borrower’s credit score utilization ratio, which can additional have an effect on their credit score.

The Implications of No Credit Check Loans

Whereas no credit check loans can provide fast access to funds, they include several implications that borrowers must consider.

Execs:

- Accessibility: No credit check loans present entry to funds for people with poor or no credit histories, helping them meet pressing monetary needs.

- Pace: These loans are often processed quickly, with funds accessible inside a brief timeframe, generally even the same day.

- Much less Stringent Necessities: Borrowers might not want to supply extensive documentation or proof of earnings, making it simpler to qualify.

Cons:

- Excessive-Interest Rates: Many no credit check loans include significantly increased curiosity rates in comparison with conventional loans, which might result in increased financial pressure.

- Threat of Debt Cycles: Borrowers could find themselves in a cycle of debt, continually borrowing to repay earlier loans, especially with payday loans.

- Potential for Predatory Lending: Some lenders may exploit weak borrowers by offering unfavorable terms, leading to monetary hardship.

Ideas for Borrowers Contemplating No Credit Check Loans

- Research Lenders: Borrowers should totally analysis lenders and browse reviews to ensure they’re coping with respected corporations. Look for licensed lenders and people with transparent terms.

- Understand the Terms: Earlier than accepting any loan supply, borrowers should rigorously read the phrases and situations, including curiosity rates, fees, and repayment schedules.

- Consider Alternatives: Discover other choices before resorting to no credit check loans, corresponding to credit score unions, community assistance programs, or borrowing from pals and family.

- Create a Repayment Plan: It is crucial to have a solid repayment plan in place to avoid falling into a cycle of debt. Borrowers ought to solely take out what they’ll afford to repay.

- Know Your Rights: Familiarize yourself with shopper protection laws regarding lending practices to avoid predatory lending.

Conclusion

Simple loans for bad credit with no credit check is usually a viable choice for individuals in need of rapid monetary assistance. Nevertheless, these loans come with inherent dangers and potential pitfalls that borrowers should navigate fastidiously. By understanding the types of loans out there, the implications of no credit checks, and the importance of accountable borrowing, individuals could make knowledgeable selections that will assist them manage their financial situations effectively. In the end, constructing a positive credit historical past ought to stay a precedence, because it opens up more favorable lending alternatives in the future.

No listing found.